Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- Why do vendors sell off-market? Cate gives a quick summary of the top reasons why a vendor might choose to sell off-market. For further insights listen to episode 85 “Off market properties – everything you need to know”.

- What has made off-market opportunities more mainstream? Off-market sales have become more trendy and sought-after because of the perception that buyers will be getting a great deal with some heavy discounting. But is that actually the case? The trio discuss the role that off-market opportunities play in the real estate game.

- How do market movements impact the quality and number of off-market opportunities? The trio discuss the ebbs and flows of off-market sales during a seller’s and buyer’s market and what you can expect from a discounting and abundance perspective.

- Why you have to do your research. Many prospective purchasers get excited by an off-market opportunity and the assumption that they’ll be taking home a winner at an excellent price. However, that doesn’t mean that buyers can take their foot off the comparable sales pedal. Buyers still need to understand the market and the quality of the property to ensure that they are getting a fair price.

- How do you identify a bad off market? Cate takes our listeners through the tell-tale signs of a bad off-market property.

- How can you tell if the off-market is genuine, or is it really a pre-market in disguise? A pre-market is a property which is not yet advertised on the market, but the agents are preparing for a sale campaign and are testing the waters before the property is advertised for sale. This can be really frustrating for buyers if they think they’ve come across a fantastic off-market opportunity, with the ability to make an offer without stiff competition from other purchasers. Cate gives some hot tips on how to deal with the selling agents to find out if the off-market is genuine.

- How does seasonality change off-market supply? The best off-markets are from vendors who are motivated to sell as they have made a financial commitment (eg: purchased a new home and need to sell) or a distressed landlord with an uncooperative tenant. So, when are these people likely to sell?

- Why are buyers so keen to field off-markets? When listings are thin on the ground, an off-market opportunity can be the break that a buyer has been waiting for. However, there are some misconceptions about off-markets which can steer buyers in the wrong direction.

Resources

- Bidding tactics 101 (Ep.20)

- Congenial negotiation tactics and how to apply them in the right situation (Ep.29)

- Preparing for auction: Part 1 – Appraising, budget setting, due diligence, reserves, low-ball offers & auction twists (Ep.73)

- Off-market properties – everything you need to know (Ep.85)

- Preparing for auction: Part 2 – Cooling off period, finance approval, negotiating terms and auction quote ranges (Ep.98)

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes

- Why do vendors sell off-market?

- Private situation/private person.

- Crazy offer from a buyer, (sometimes an underbidder from a nearby property).

- Very short time frame – too short for an auction.

- Bad/non-compliant tenant in an investment property.

- Trying to save advertising costs.

- Tough property to sell and wanting to avoid a campaign that ‘cooks’ the property.

- How have off market property alerts changed over time?

- What has made them more mainstream?

- This has become more trendy because of the perception that you can getter a better deal on an off market property.

- It’s become a marketing tool for real estate agents, especially with proliferation of buyer’s agents.

- Agents used to go directly to the advocates, or to a buyer that they were very familiar with who has been active in the market and missed out – someone who can make a quick decision and have money.

- They are now using it as a selling tool for their agency – exciting off market opportunity text message going out to their database.

- Almost any old Joe is getting those messages. Some agents will have a section on their website for off-markets.

- Not as aggressively a sellers market anymore (not a buyer’s market just yet). A lot of vendors who were committed were caught out. Campaign that unfortunately was running through when covid broke. We saw a lot of them pushing forward with desperate motivated off markets. The quality of off-markets and discounting was stronger back then. The recent off markets are an indication of a market that’s losing the heat. People don’t want to take their property to market. There’s nothing harsher than watching your property pass in on auction day. That vendor will just want a private off-market.

- Comparable are really important

- You get excited by an off market opportunity, and some people may not do the comparable sales.

- The market is cooling, it won’t go backwards, but it will be easier to buy at auction.

- Do your research.

- Cate – One in four are purchased off market – one in eight properties reviewed are off markets.

- What defines a bad off market?

- If the property has a compromise that’s obvious (main road or trainline, opposite school, next to service station)

- If the property is really badly presented, looks like a diamond in the rough, that can be a great thing.

- Price expectation – be clear with the agent on the price tag. If the agent gives a range, it’s probably a pre-market, not an off-market. Or the vendor wants something a lot higher.

- Agents will call all of them off-market. Ask if this one is potentially going to auction, is it a pre-market or off-market.

- The agent will be really clear about the date or the term for a genuine off-market

- How does seasonality change off market supply?

- You find that the best off-markets are someone who has committed financially and they have to sell. Closely followed by a landlord in distress with a difficult tenant. That’s where the high quality markets come from, very rare to get a secret sale from a media personality.

- When will these deals come about?

- They usually follow a selling season, like a late title wave. The follow on, immediately after someone has made a purchase, late spring into summer and late autumn.

- They may only have to open the door twice.

- Why are buyers so keen to field off markets?

- When listings are thin on the ground, they are getting more opportunity

- If it’s an exclusive conversation with someone who’s motivated to sell, it’s a great opportunity to purchase without competition.

- Delusional reason is that they think that an off market will be a brilliant opportunity to get a discounted price – ensure the property hasn’t got fundamental flaws or is over-priced.

Gold Nuggets

Peter Koulizos – The Property Professor’s Golden nugget: stay calm, don’t get too excited, do your research and look at comparable sales. Same suburb, similar block of land, similar house and similar condition. Buying and investing in property is a long-term game. If you’ve done the research and you know the market, it doesn’t matter how you buy.

Cate Bakos – The Property Buyer’s Golden nugget: don’t be afraid of auctions.

Market Updates

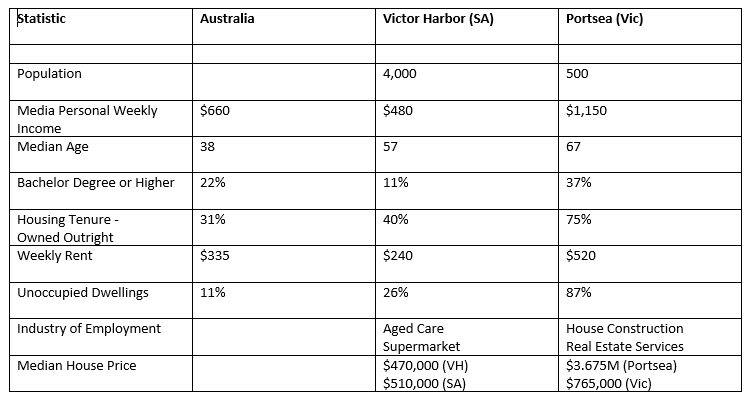

- Victor Harbor vs Portsea. As promised, the Property Professor presents his research on why regional towns in South Australia such as Victor Harbor are so much cheaper than regional towns in Victoria, such as Portsea. Pete shares with listeners the key data sets and demographics that, in tandem he believes are determinants for determining the drivers for values and price growth rates in these two holiday destinations.