Android

Android

Highlight Segments

1.43 – Mike ploughs into the stats! He also hints at our next ep… an insight into Perth

12.00 – What’s happening in the regions? Are the COVID-escapees leaving in droves?

13.45 – Mike explores Victorian investor-driven sales and asks Cate who is buying this stock

21.23 – Mike chats with Cate about the data she has shared on Perth in a recent Core Logic release on rents.

22.00 – Teaser from next week’s episode… All things PERTH!

24.22 – Listing activity is UP! The Trio discuss the reasons why, and they point out the resilience of the market

23.20 – Dave cites some pretty scary stats for rental stock availability

40.28 – Gold nuggets!

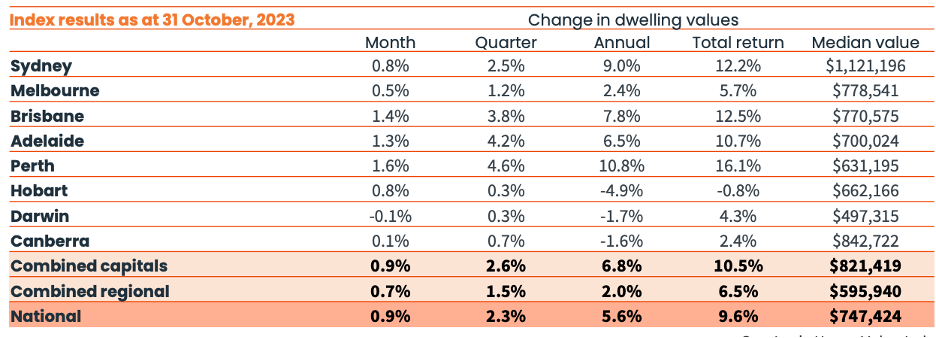

1. Home Value Index Results

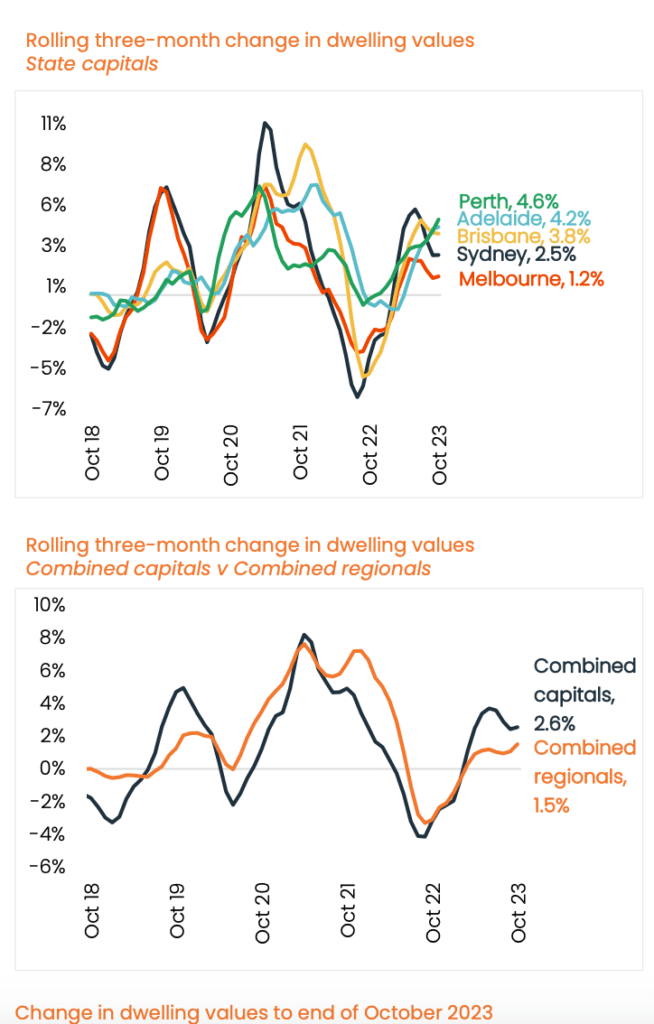

The October data has Perth leading the chart, but as Dave reports, the mid-sized capitals are the capitals that are showing us the strongest results. There is a correlation between growth and listing rates though. Listings have jumped in Spring for Sydney and Melbourne, supporting Dave’s correlation theory.

Cate identifies data integrity issues, citing Hobart’s data as an example. All it would take is a disproportionate number of listings at either end of the market to skew a data set in a city as tight as Hobart.

Source: CoreLogic

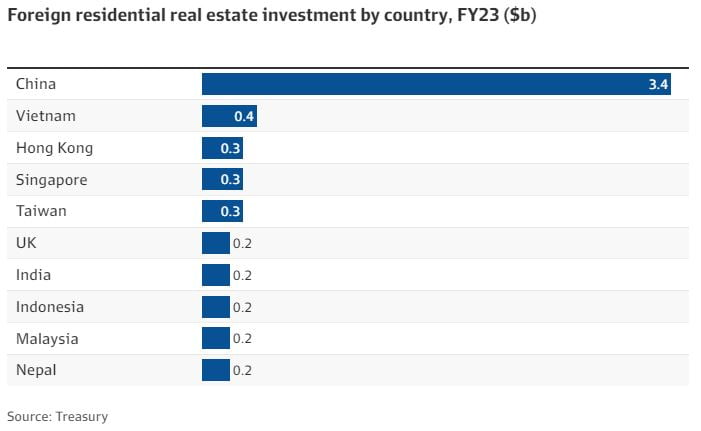

2. Foreign buyer impact on the property market

The Trio ponder the re-emergence of foreign buyers, especially Chinese, and changes other countries have undertaken to protect price appreciation from overseas buyers.

Dave shares that the rate of immigration to Australia is estimated by the Immigration Department to have reached 500,000 in the 12 months to September, an all-time high, hence putting additional pressure on housing and perhaps more importantly, inflation.

- Are the mid-cities thriving because they are more affordable right now?

And what impact is the return to the city by the tree-changers and sea-changers having on the data? Cate explains…

Cate shares some insights into investor-led sales, and she also talks about which buyers are soaking up these investor sales. Check out our Resources below for more.

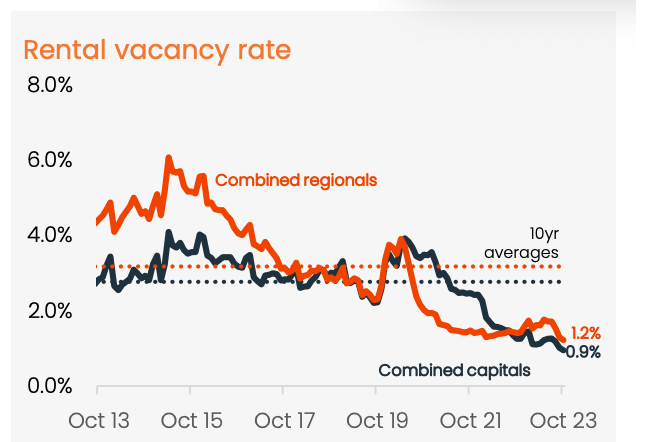

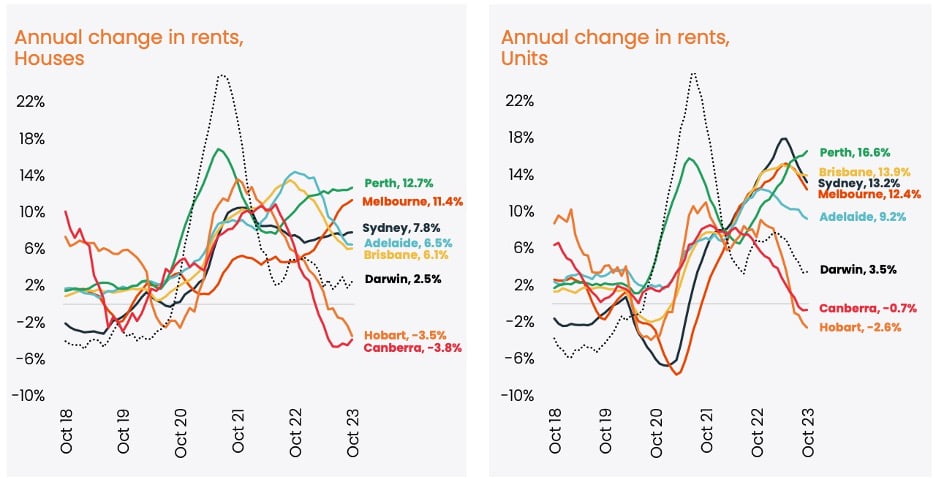

- Vacancy rates and rental growth

No real respite in store for renters in most cities, unfortunately. The Trio note that the vacancy rates are as low as they’ve seen in their time.

At this stage, there is no real stimulus on the horizon that is likely to change this issue for renters. Dave cites some scary stats. But as Cate points out, household formation rates may return to former levels as house-sharers re-band, young adults move back ‘home’, and singles re-partner.

Source: CoreLogic

Source: CoreLogic

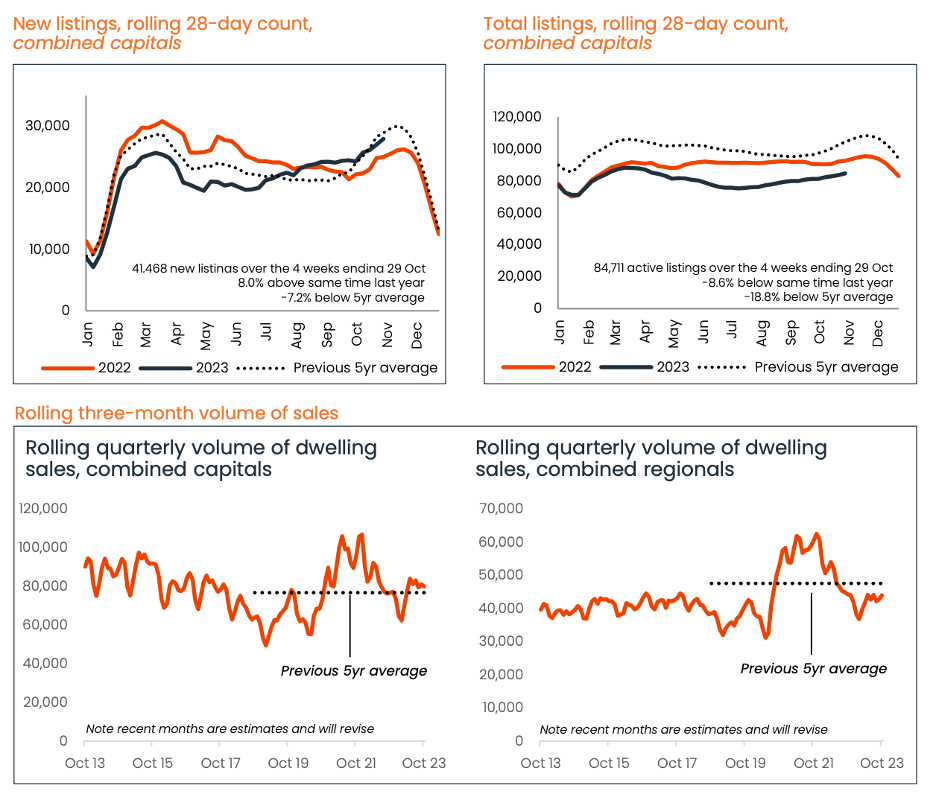

- What’s the story with listings

Listing activity is up nationally, but the Trio discuss the drivers for this, the differential compared to past years, and the overall resilience of the market.

Mike wonders whether the number of Perth sales could be initiated by vendors who have been practising Loss Aversion. Are they happy to sell, now that values have finally returned?

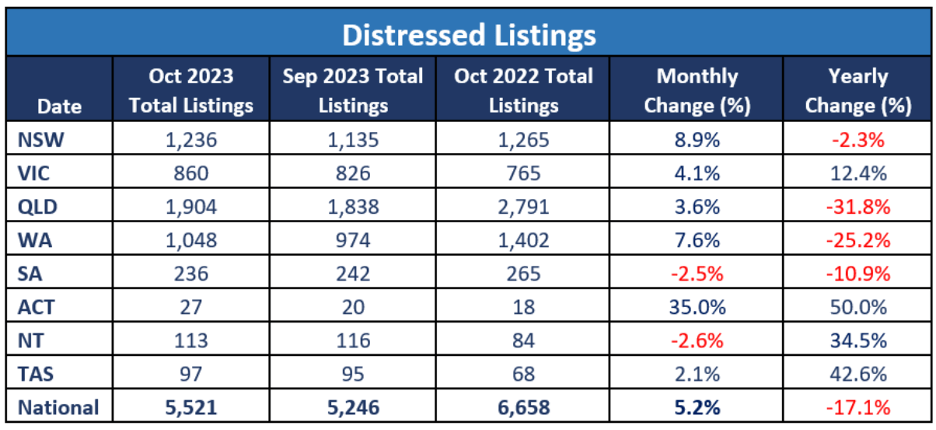

And the opposite of Loss Aversion is a Distressed Sale

Cate and Dave point out the fact that the states that the media report are ‘in crisis’ are not showing large numbers of distressed sales, relative to total listings. In Mike’s words, “Media beat-up?” Maybe.

Source: CoreLogic

Source: SQM Research

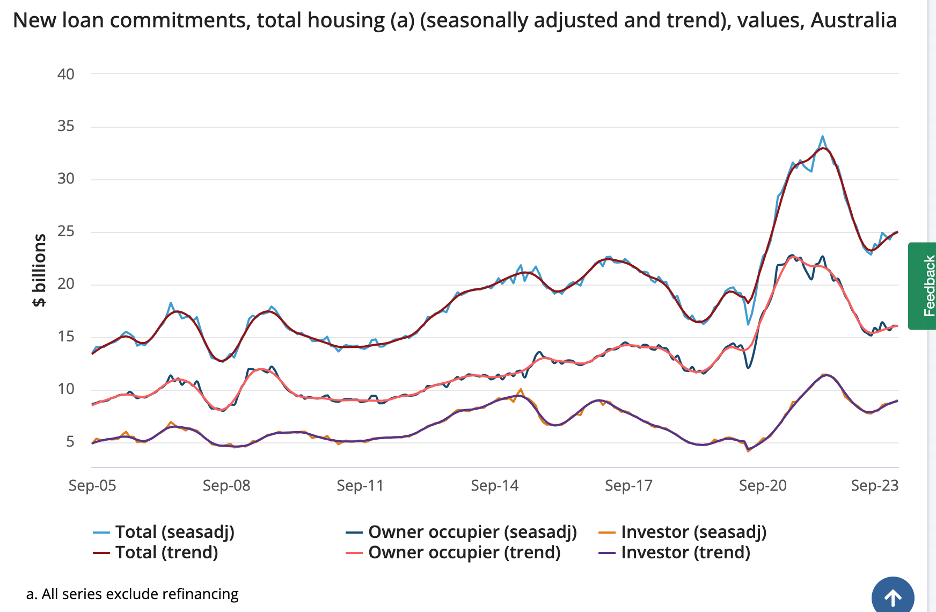

- Loan numbers

Total housing lending fell 7.8%, but it’s still 1.5% higher than a year ago. The ‘mortgage wars’ we saw in past months are not quite as rampant as they were. Dave proposes we’ll see some competition in refinances.

Will APRA bring down the buffer? Tune in to hear Dave’s thoughts….

Source: ABS

Gold Nuggets

Cate Bakos’s gold nugget: New listing activity for the remainder of the year….. most markets slow down for Christmas break. So, for anyone who is thinking that 2023 has a few exciting listings to come out; we only have a couple of week’s new listings remaining.

Dave Johnston’s gold nugget: It’s a good buying time in Melbourne and Sydney with rising stock levels. Dave feels that this ‘purple patch’ opportunity for buyers will continue.

Resources

Cate’s blog on investor-led sales here

Ep. 68 – Renovations Part 1: Top tips and mistakes to avoid

Ep. 70 – Renovations Part 2: Planning for success and insights from the federal budget

Ep. 143 – Property Planning Case Study #1: What’s our next move?