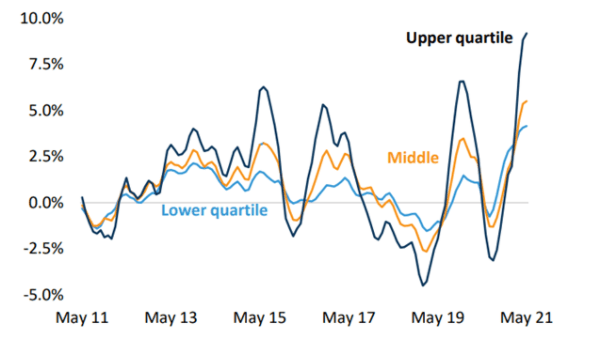

In a bull market, the upper quartile (top 25%) tends to outperform, as is happening at the moment. This is because the people who have more money, spend proportionately larger sums on higher priced properties than those in the middle and low quartiles when they feel wealthy.

In a bull market, the upper quartile (top 25%) tends to outperform, as is happening at the moment. This is because the people who have more money, spend proportionately larger sums on higher priced properties than those in the middle and low quartiles when they feel wealthy.

Conversely, during a downturn, the wealthy who purchase in the upper quartile tighten the belt the most. Causing the cohort of upper quartile properties to fall the furthest. This is compounded by the fact there are less buyers overall who are circling the top quartile properties.

Simply, there is less demand for upper quartile properties. Which is heightened during downturns because less wealthy people can’t afford to purchase in the upper quartile. Yet, wealthy people can purchase lower value properties.

As we’re in the midst of one of the greatest post-recession recoveries in history, we’re seeing this upswing play out across capital cities, where the upper quartile of property values increased by 9.2% in the last quarter, and only 4.2% in the lowest quartile.

This reinforces the seemingly intractable truth of buying in a falling market. Best illustrated in the upper echelons of property values which fall the most, and redound the most, that ‘buying the dip’ at the top end is likely to provide the greatest return.

Check out the latest results from CoreLogic