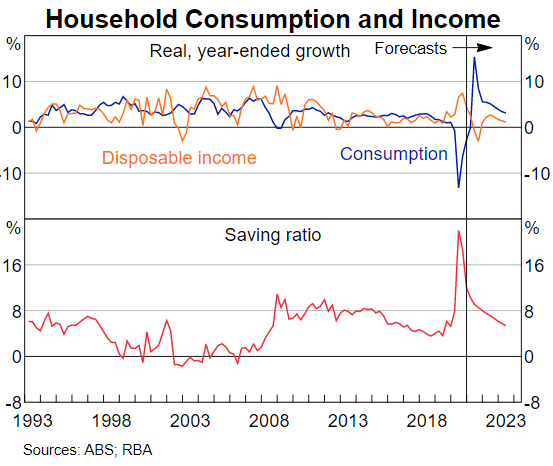

The household savings ratio of income we save (normally at ~5%) hit historic highs of 19% in 2020, and dropped to 12% by the end of 2020 as we suppressed the virus and spent up big on everything, including housing. Increased consumption is good news for the RBA & government because it drives the economy reflected in record job advertisements and unemployment falling to 5.5%.

The household savings ratio of income we save (normally at ~5%) hit historic highs of 19% in 2020, and dropped to 12% by the end of 2020 as we suppressed the virus and spent up big on everything, including housing. Increased consumption is good news for the RBA & government because it drives the economy reflected in record job advertisements and unemployment falling to 5.5%.

Savings levels are expected to fall to 8% in 2021 and over time, our dwindling reserves will slow the consumer-led economic recovery adversely impacting the property market. This, plus an increase in fixed rates, may provide the impetus to stifle price growth, gradually.

The government want property values to rise at a sustainable level leading into the next election because the ‘wealth effect’ means that we spend more if our assets grow in value.

This all points to the likelihood of property values increasing into 2022 up until the election as the government will only encourage policies intervention such as lending restrictions as a last resort so not to hamper our economic recovery, and cost votes.

Ironically, in complete contrast to after the previous election where property values rapidly bounced back, the property market take a negative turn ‘following’ this election.