Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- Regions vs capital city performance

Pete shares data from the ABS on capital city and regional performance since 2003 to March 2020 (pre-covid) and 2003 to March 2022 (post-covid). So, what has changed and what are the themes that have impacted how each have performed?

- What’s driving capital growth in our top performing regions?

David shares his research on the top performing regions in each state and the driving force behind property value growth. For any listeners looking to invest in a regional location, there are commonalities between each of the high performing regions and also the fundamentals of property investment which are relevant to capital cities also apply. Tune in to find out.

Resources

- Capital cities vs regions – ABS data – pre and post covid

- #14: How to choose a location for investment – what to look for and what to avoid

- #52: Dissecting 10 years of Core Logic data – capital cities & regional centres

- #89: Capital growth – what increases property value?

- #150: Migration trends – Outlook for population growth, will Melbourne recover from population losses, interstate and intrastate trends, which regions face ageing population risks and high job vacancies, the future for international and internal migration

- #163: Predictions for 2022 revisited – Which predictions are on track, where we went wrong, revised expectations & forecasts. Half yearly report on capital cities, regional locations, the top performers & what do we expect in the back half of the year

- Beware of an investment sprinkled with a little lifestyle

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes

How have capital cities performed vs rest of state regions pre and post – covid

- Sydney/NSW – Sydney and regional NSW increased at exactly the same amount pre-COVID-19 – 98% increase in property prices.

- Sydney/NSW – Regional NSW performed far better than Sydney if you include the two COVID-19 years – 224% (regional NSW) vs 159% (Sydney)

- Melbourne/Victoria – Melbourne was the better performer pre COVID-19 – 147% vs 122%.

- Melbourne/Victoria – Regional Victoria zoomed ahead of Melbourne during COVID-19 – 264% (regional Victoria) vs 215% (Melbourne)

- Brisbane/QLD – Regional QLD was the better performer pre COVID-19 – 118% vs 101%.

- Brisbane/QLD – Brisbane is the better performer when you include COVID-19 – 193% vs 169%

- Adelaide/SA – Adelaide was the better performer during both periods – 101% (pre COVID-19) and 177% (including COVID-19)

- Perth/WA – Regional WA was the better performer during both periods – 111% (pre COVID-19) and 166% (including COVID-19)

- Hobart/TAS – Hobart was the better performer during both periods.

- Hobart/TAS – Hobart was the best performing location in the nation – 220% (pre-COVID-19) and 356% (including COVID-19)

- Darwin/NT – Darwin was the better performer during both periods – 120% (pre-COVID-19) and 180% (including COVID-19)

- Canberra – Canberra house prices increased 100% pre-COVID-19

- Canberra – Canberra house prices increased 196% including COVID-19

PRE-COVID-19: 2003 to March 2020

- Hobart – 220%

- Tas regional – 168%

- Melbourne – 147%

- Vic regional – 122%

- Darwin – 120%

- QLD regional – 118%

- NT regional – 115%

- WA regional – 111%

- Perth – 102%

- Adelaide – 101%

- Brisbane – 101%

- Canberra – 100%

- Sydney – 98%

- NSW regional – 98%

- SA regional – 93%

INCLUDING COVID-19: 2003 to March 2022

- Hobart – 356%

- TAS regional – 316%

- Vic regional – 264%

- NSW regional – 224%

- Melbourne – 215%

- Canberra – 196%

- Brisbane – 193%

- Darwin – 180%

- Adelaide – 177%

- QLD regional – 169%

- WA regional – 166%

- Sydney – 159%

- SA regional – 141%

- NT regional – 136%

- Perth – 133%

Statistical Area Level 3 (SA3) – what is it?

- Statistical Areas Level 3 (SA3) are geographical areas built from whole Statistical Areas Level 2 (SA2).

- They have been designed for the output of regional data, including 2016 Census data.

- SA3s create a standard framework for the analysis of ABS data at the regional level through clustering groups of SA2s that have similar regional characteristics.

- Whole SA3s aggregate to form Statistical Areas Level 4 (SA4).

- In the major cities, SA3s represent the area serviced by a major transport and commercial hub. They often closely align to large urban Local Government Areas (e.g. Gladstone, Geelong).

- In outer regional and remote areas, SA3s represent areas which are widely recognised as having a distinct identity and similar social and economic characteristics.

- There are 358 spatial SA3 regions covering the whole of Australia without gaps or overlaps.

Regional NSW – Highest performers

Drivers of regional growth – Lower Hunter

- Proximity to the major capital city – 50 mins to Newcastle, 1 hr 50 mins to Sydney

- Proximity to beach – 49 mins

- Ave climate – winter 18-20 degrees

- Population – est 94,734 (2020) / Newcastle 322,278 (2016) / Sydney 6.13M (2021)

- Median age – 8 (2020) / 38 years NSW (2016)

- Median income – $52,252 (2020)/ $51,389 NSW (2019)

- Older towns – 1830

- Quality of local nature –national parks, lakes, world heritage wilderness area. Vinyards one of Australia’s oldest grape-growing regions. Dining – artisan foods and farm-fresh produce, farmers markets. Day spas, golf courses, hunter valley zoo

- Towns in the region –

- Singleton

- Cessnock

- Branxton

- Industry – The Hunter is Australia’s largest regional economy, valued at over $40 billion. The region prospers economically and socially, supported by a highly professional and skilled workforce and strong research, health, tourism, manufacturing and defence sectors.

- Farming – Herbs, Apples, Turkeys, Sweet corn, Lettuce, Pears, Plantation fruits, Nurseries, outdoor Mushrooms, Almonds, Bananas, Tomatoes, Macadamias, Grapevines, Cut flowers, Pecans, Grapes for wine, Avocados, Cultivated Turf Raspberries, Strawberries, Mangoes

- The Port of Newcastle is the largest coal export port in the world, with its overall exports valued at almost $18.5 billion in 2016-17.

- Williamtown RAAF base sits at the heart of the region’s defence sector and is supported by a hub of important defence and aerospace companies. It is co-located with the Newcastle Airport, currently servicing 1.2 million passengers annually.

Regional VIC

Drivers of regional growth – Colac-Corangamite

- Proximity to the major capital city – 60 mins to Geelong, 1 hr 50 to Melbourne

- Proximity to beach – 48 mins to Lorne

- Ave climate – winter 4-13 degrees

- Population – est 37,498 (2020) / Geelong 253,269 (2016) / Melbourne 5.08M (2019)

- Median age – 46.2 (2020) / VIC 38 (2021)

- Median income – $43,674 (2019) / $51,027 (2019)

- Older towns – proclaimed a shire in 1864, by 1870’s almost 700 people lived there

- Towns in the region –

- Apollo bay

- Cobden

- Camperdown

- Terang

- Quality of local nature – rural town set amongst picturesque volcanic plains and 30+ lakes, surrounded by quaint townships and offering a smorgasbord of things to do and see, botanic gardens, rainforest and tree top walk, heritage buildings, bird sanctuary, museums, cycling track following Old Beechy Rail Trail, wining and dining

Regional QLD

Drivers of regional growth – Gold Coast Hinterland

- Proximity to the major capital city – 23 mins to Surfers paradise, 1 hr to Brisbane

- Proximity to beach – 23 mins to Surfers Paradise

- Ave climate – winter 9-21 degrees

- Population – est 20,350 (2020) / Surfers paradise 23,689 (2016) / Brisbane 2.28M (2016)

- Median age – 46.1 (2020) / QLD 38.5 (2021)

- Median income – $48,596 (2019) / $50,298 (2019)

- Older towns – 1865

- Quality of local nature – premier holiday destination/activities, theme parks, beaches, shopping, night life, vinyards, waterfalls, national parks, outdoor activities (high ropes/zipline)

Regional SA

Drivers of regional growth – Limestone Coast

- Proximity to the major capital city – 3 hrs 30 mins to Adelaide, 2 hr 20 mins to Horsham VIC

- Proximity to beach – on the beach

- Ave climate – winter 5-14 degrees

- Population – est 67,365 (2020) / Horsham 14,453 (2016) / Adelaide 1.3M (2016)

- Median age – 6 (2020) / 41 (2021)

- Median income – $45,601 (2019) / SA $49,888 (2019)

- Older towns – settled since 1840’s

- Towns in the region –

- Mount Gambier

- Penola

- Coonawarra

- Naracoorte

- Kingston

- Industry – It is built from traditional agriculture based activities, but has now expanded to include forestry, manufacturing, tourism, engineering, transport, retail, health, education and service industries.

- Quality of local nature – The Limestone Coast has jaw-dropping natural wonders, lush wine country, sprawling sandy-white beaches and unique experiences to spark your curiosity – lakes, sink holes, beach, caves, national parks, wine regions (Coonawarra). Mount Gambier – second largest town in South Australia

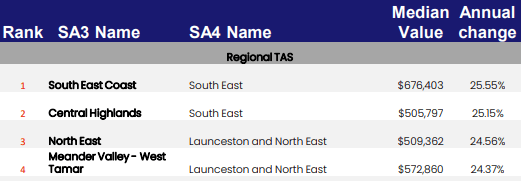

Regional TAS

Drivers of regional growth – South East Coast

- Proximity to the major capital city – 1 hr to Hobart

- Proximity to beach – on the beach

- Ave climate – winter 4-13 degrees

- Population – est 7,199 (2020) / Hobart 206,097 (2016)

- Median age – 56.6 (2020) / 42 (2021)

- Median income – $37,487 (2019) / TAS $47,352 (2019)

- Older towns – settled since 1831

- Towns in the region –

- Orford

- Triabunna

- Swansea

- Coles Bay

- Industry – Tasmania is truly the breadbasket of Australia – the carrots, broccoli, peas, beans, cauliflower, potatoes, barley, wheat, oats, apples, pears, apricots and cherries, Vinyards, meat and dairy

- Quality of local nature – vinyards, beach, national parks, Island national parks

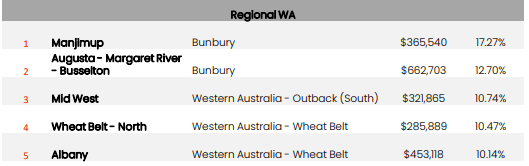

Regional WA

Drivers of regional growth – Manjimup

- Proximity to the major capital city – 1 hr 30 mins to Bunbury, 3 hr 15 mins to Perth

- Proximity to beach – on the beach

- Ave climate – winter 7-15 degrees

- Population – est 23,253 (2020) / Bunbury 43,310 (2021) / Perth 1.98M (2016)

- Median age – 48.1 (2020) / 36 (2016)

- Median income – $39,670 (2019) / WA $54,220 (2019)

- Older towns – settled since 1856, took off in 1910 as a result of railway line that was built

- Towns in the region –

- Manjimup

- Pemberton

- Northcliffe

- Donnybrook

- Industry – agriculture, timber, tourism and public administration.

- Quality of local nature – Margaret River, State forests, lake, beach

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget:if you’re going to invest in a regional location, do the same level of research as you would buying in a capital city. A lot of the same fundamentals which drive outperformance in capitals are the same which drive outperformance in regional locations. Ultimately, do your research and try to remain impartial. Understand the numbers and the demographics, but also the lifestyle, liveability factors that people desire in the location. There is a lot of commonality.

Peter Koulizos – The Property Professor’s Golden nugget: If you’re investing in property, you need to have a longer timeframe than 2 years. Short term is 10 years, medium term is 20 years, long-term is 30 years. Don’t just look at who was the best performer last year, or during covid. Go back, work out who but why. Was there gentrification, was it a move from the city to the country, universities, industry. So yes, quantitative analysis is good, but you need to do some qualitative research. Travel to the area and check out what the drivers could be

Market Updates

- Adelaide market losing steam

Pete reports that there are not as many people at auction and less offers coming in prior to auction. Whilst the Adelaide market is still on the rise, it isn’t increasing at the same rate as a month and a year ago. CoreLogic figures released this week show 0.4% increase over July

- Rental squeeze

Cate shares an interesting article that she read on the weekend, highlighting the Victorian rental reforms to be a failure and go too far. With the pool of rentals eroding, vacancy rates reducing and rents on the upward trend, are the reforms pushing investors out of the market with their onerous requirements?

- Where is the neutral cash rate?

Dave shares his updated predictions on where the neutral cash rate could lie (2-2.5%). The current cash rate of 1.35% is above the level of June 2019 and almost double the pre-pandemic level. With a 0.5% rise expected today, the new 1.85% cash rate will be the highest since July 2016. This sparks concern that the RBA is going too hard and too fast. Inflation is a concern, but not at the expense of household wealth and jobs. Figures from Westpac show that while 29% of borrowers are a year ahead of repayments, 50% are less than one month ahead.