Schedule a free consultation with our team today.

Perfect for the busy professional seeking a low risk approach to creating their ideal lifestyle.

Get Started

Property Planning Australia

Proven Excellence Since 2004

Last year we were honored with the Best Mortgage Business in Victoria and Tasmania, as well as the Best Customer Service Award at the esteemed Mortgage and Finance Association of Australia (MFAA) Excellence Awards.

Since our inception in 2004, we have been fortunate to receive dozens of awards, recognising our commitment to excellence in service and advice across our Strategic Mortgage Broking and Property Planning services.

Property Planning

Leverage our cutting-edge Property Planning software

We help you create a personalised Property Plan that empowers you to achieve your retirement objectives effectively through property.

Our goal is to empower you to build a Property Plan that connects your lifestyle and financial goals to your property decisions, from your next purchase to your last.

With our exclusive Property Planning Platform, you’ll receive lifetime access with no ongoing fee.

Our software puts you in control of developing multiple Property Plan pathways, based on your existing financial position, for you to contrast and compare. The software also allows you to update your situation in real time and ongoing, all the way through to a successful retirement.

Planning brings the future into the present so you can do something about it now

Contact us now to find out more

A faulty mortgage strategy will cost you from the day of settlement.

This cannot be reversed – only rectified from now!

Strategic Mortgage Broking

Unleash the Power of Mortgage Strategy for Long-Term Financial Success

While most lenders and mortgage brokers sell you a product and a rate, we prioritise setting up an effective mortgage strategy that will:

- Allow you to hold property while acquiring new assets

- Optimise tax deductions

- Allow you to take control of your money management

- Optimise the use of offset accounts

- Support you to manage risk

- Determine the right repayment strategy

By working with our Strategic Mortgage Brokers and Private Banking team, you can be assured of selecting the right lender and obtaining a great rate across our network of over 40 lenders.

Our award-winning service is ongoing for the life of the loan, ensuring that you receive unparalleled support and guidance.

Contact us now to find out more.

Read David’s articles for Domain and the Australian Financial Review

Strategic Mortgage Broking

Property Planning

Five ways to create wealth through your mortgage

How to keep your first home as an investment when upgrading

Why short-term investing has long-term consequences

How data helps investors identify gentrification

Media we have worked with

Hear from our clients

Gwenda

Thomastown, VIC

Andrew

North Rocks, NSW

My partner and I engaged Property Planning Australia after being told about the benefits of property planning more generally. We’ve been incredibly happy with their service up to this point. They’re informed, responsive, thorough, and consistently professional. We’re on the start of our property journey and, frankly, find it incredible that more people don’t engage firms like Property Planning Australia given the costs of purchasing in Australia—and the costs of overlooking seemingly ‘minor’ details when deciding what to purchase, where to purchase, and when to sell, etc. They’ve been an invaluable partner to us as we navigate Sydney’s crazy housing market and couldn’t recommend them more.

Jesse

Southport, QLD

Property planning Australia helped us get our first mortgage for our new family home. The whole process right from the start to the very end was incredible. Everyone who we dealt with were always so helpful and were able to answer any questions we had, they always kept us up to date with what was happening. Even after we had purchased & settled on our home they contacted us to make sure everything was going well with the home. I would highly recommended Property planning Australia to everyone. 10/10 experience.

Philip

Malvern East, VIC

Dave & the team at Property Planning helped me into my first house in Malvern East almost 15 years ago & have done it again in 2020. The experience was excellent with regular communication all the way through. Now, almost 3 months after settlement we are still getting follow ups ensuring that everything is as expected. 5 stars & strongly recommend PPA as a friendly & professional broker for anybody looking to buy!

Charlie

O'Connor, ACT

David Johnston and the Property Planning Australia team have been fantastic. They have helped us with our longer term property planning and helped us developed an informed strategy for our next property decision. Plus they made our home loan application simple and easy.

Their ongoing service and support we received was another added extra and they offer more than a traditional Mortgage Broker would. I would highly recommend using their services.

Angelina

West End, QLD

I’ve been using the mortgage brokers at Property Planning Australia for almost 10 years (refinancing and mortgage for new investment properties). I’m now searching for a home hence, needed help with using equity from my existing properties and a new loan. Andrew Edmonds has been awesome in providing me with the best options for my situation and getting the equity for my deposit loan approved + a better home loan rate :-). I definitely wouldn’t have been able to do it on my own.

Andrew

Hawthorn, VIC

The whole process from my first contact, to receiving the completed plans this week has been fantastic and I feel much more confident in my decisions now. You have both helped me increase my knowledge and view of property investment to levels I never would have thought possible six months ago! So again thank you!

Steve

Hamilton, QLD

Paul

Wahroonga, NSW

We recently settled on our first property in Australia after relocating from Hong Kong . The crew at Property Planning Australia have been awesome helping to educate us on the buying process and then secure financing for our purchase . A special thank you to Michael Hulston, Richard White and their teams who made what can be a stressful process very straightforward . We hope to continue to work with the team as we look to expand on our property investments in the years to come.

Rachel

Flemington, VIC

David Johnston and his team have been an incredible resource and asset to my husband and I. Their guidance and assistance with Property Planning and Mortgage Strategy has been invaluable. As a young couple ready to take the first steps to buying our first home we feel like we couldn’t be in better hands. No question is too big or too small and they’re always willing to have a chat and re-explain things, at no point did I feel embarrassed about ‘not getting it.’ I didn’t know the first thing about property before working with David and his team. Buying my first home is a big step in my life and I’m glad I have David in my corner. Would highly recommend!

Marlene

Woodford, NSW

I have negotiated 3 investment home loans via Richard and the team at Property Planning Australia over time and thoroughly recommend PPA with regards to respectful service, prompt communications and range of mortgage products.

Esteban

Mascot, NSW

They have helped us to better understand and properly set up our money management, and are helping us to establish the best pathway for a family home and investment property

Mojtaba

Doncaster, VIC

Buying my property is the most important and most expensive investment of my life. I needed my investment strategy and plan to be perfect; therefore, I started searching for the prefect adviser. I talked to more than 50 buyers’ agents and companies across Australia. I believe the property planning Australia is the best company in Australia. This is mainly because their business model is free of conflict of interest (They don’t accept kickbacks, which is very rare in their business). Importantly, they try to empower their clients so they can understand all complexity of property market and decide the best course of actions themselves. Their staff are kind, caring, and supportive. Throughout my journey, I learnt a lot about the property market and how we can make money in this market. I really appreciate Property Australia for this.

Lucy

Glen Waverley VIC

Lorraine

Warradale SA

Warrick

Waverton, NSW

PPA provides an excellent service – extremely knowledgeable, efficient, and responsive, with great communication and a ‘can do’ attitude.

Samantha

Richmond, VIC

Ryan & the team at Property Planning Australia were extremely helpful during what can be a pretty stressful time buying your first home! He was always available to chat and answer and questions and it made the process so much easier than it could have been! Highly recommend Ryan & the team!

Steve

Bronte, NSW

I have had the immense pleasure of being on the receiving end of Property Planning’s amazing services. I would highly recommend the team here from many years of being a client. Thank you

Jess

Glandore, SA

Highly recommend Property Planning Australia. Ryan and the team understood what we were looking at, helped refine our decisions and came up with a few solutions to maximise our position. Fast and accurate.

Georgina

Surrey Hills, VIC

We’ve been with PPA for over 8 years, and have found the team to be very proactive, communicative and professional. Highly recommend PPA for selecting a property and also as mortgage brokers.

Lincoln

Annerly, QLD

I have worked with PPA for over 10 years and maintained relationships with the same people the whole way. Its a familiar experience that i trust and would recommend to anyone looking for unbiased expert information. I will continue to be a customer for a long time to come.

Listen to Our Podcast

Listen to Our Podcast

180+ 5 star Reviews, Over 400,000+ Downloads

Join the Property Planner, David Johnston, The Property Buyer, Cate Bakos and the Quantity Surveyor, Mike Mortlock as they take you on a journey of discovery through the maze of property, mortgage, and money decisions to empower you to create your ideal lifestyle!

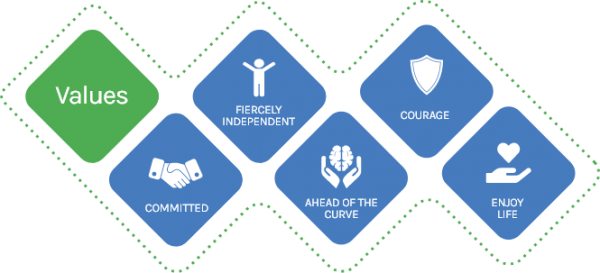

How Are We Different?

Fiercely Independent Property Advice

We do not sell Property. We do not act on behalf of property developers, project marketers, selling agents, buying agents, or financial planners. We have zero location bias, as we no longer buy property, despite being one of the first buyer’s agencies from 2004 – 2011. Determine a strategy that is right for you, not your buyer’s agent location. We refer you to the best buyer’s agents across Australia, so your property strategy matches your Property Plan.

No Investment Products

We do not sell investment, financial or insurance products.

Bespoke for professionals

Your Property Plan and Mortgage Strategy is tailored to your unique circumstances.

Mortgage Strategy

Most lenders and mortgage brokers do not understand how your Mortgage Strategy can empower you to create wealth, manage risk and align with your Property Plan. Speak to someone who does more than sell products or interest rates.

We all know 3.9% is lower than 4%!

Learn how to

- Optimise and preserve tax deductions

- Hold property as you accumulate

- Set up an effective Money Management System

- Manage risk

- Optimise the use of offset accounts

- Have an effective repayment strategy to support all of the above.

Lifestyle and Investment Strategy

It is vital that your lifestyle pathway is considered in conjunction with your investment pathway and not in isolation. Property is the only asset class we live in and most wealth is lost via property decisions that ignore the future home in your investment plans.

Property Plan

Get access to the first and only Property Planning platform in the country where you can craft and design your own Property Plan through to retirement to see how you can achieve your financial goals. The algorithm will help you uncover when you should buy and at what price point to achieve your goals, and you can map out different journeys, all with the guidance of one of our expert Property Planners.

Work with the creators of the Property Planning concept since 2004.

Unique Expertise

Our unique expertise has evolved over thousands of conversations since 2004. We know the questions that you need to ask to make superior decisions now and for the long-term.

How to Succeed with Property to Create your Ideal Lifestyle

Property for Life: Using Property to Plan Your Financial Future

Our process includes 4 four steps:

STEP 1

Plan

STEP 2

STEP 3

Select

STEP 4

Member

David Johnston

Founder and Managing Director